There are numerous personal finance apps available to help individuals manage their money, track expenses, budget effectively, and achieve their financial goals. Here are some popular personal finance apps:

Mint: Mint is a free app that allows users to track their spending, create budgets, and monitor their credit score. It syncs with bank accounts, credit cards, and other financial accounts to provide a comprehensive overview of your finances.

YNAB (You Need a Budget): YNAB is a budgeting app that focuses on giving every dollar a job. It helps users prioritize spending, save money, and get out of debt by encouraging them to allocate funds to specific categories based on their financial goals.

Personal Capital: Personal Capital offers both budgeting and investment tracking features. It provides tools for managing cash flow, analyzing investment performance, and planning for retirement. Personal Capital also offers a paid advisory service for wealth management.

PocketGuard: PocketGuard helps users track their spending, set savings goals, and manage bills. It categorizes expenses automatically and provides insights into spending patterns to help users make informed financial decisions.

Truebill: Truebill helps users identify and cancel unwanted subscriptions, track spending, negotiate bills, and monitor their credit score. It aims to help users save money by optimizing their expenses and managing their finances more efficiently.

EveryDollar: EveryDollar is a budgeting app developed by financial guru Dave Ramsey. It follows a zero-based budgeting approach, where every dollar is allocated to a specific category. Users can track expenses, set savings goals, and plan for future expenses.

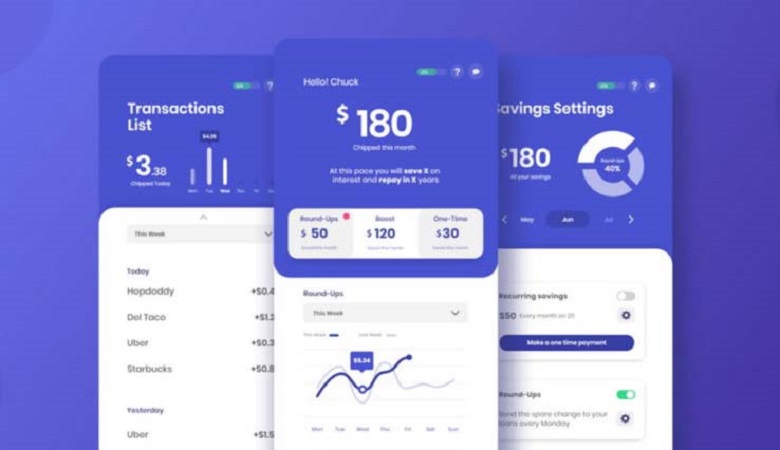

Acorns: Acorns is an investment app that rounds up everyday purchases to the nearest dollar and invests the spare change in a diversified portfolio. It also offers automated recurring investments and retirement account options to help users grow their wealth over time.

Robinhood: Robinhood is an investment app that offers commission-free trading of stocks, ETFs, options, and cryptocurrencies. It provides a user-friendly interface and is popular among beginner investors looking to start investing with small amounts of money.

These are just a few examples of personal finance apps available to help individuals manage their money more effectively. When choosing a personal finance app, consider factors such as ease of use, features offered, security measures, and compatibility with your financial goals and preferences.